Compare XM account types and which account should you open?

When deciding to open an XM trading account, you will be hesitant about which account type to choose from the various XM account types. Therefore, in this article, I will compare them and provide advice on which account best suits your needs. In this article, let us learn and compare the different types of XM accounts together to help you choose the most suitable account for your investment needs.

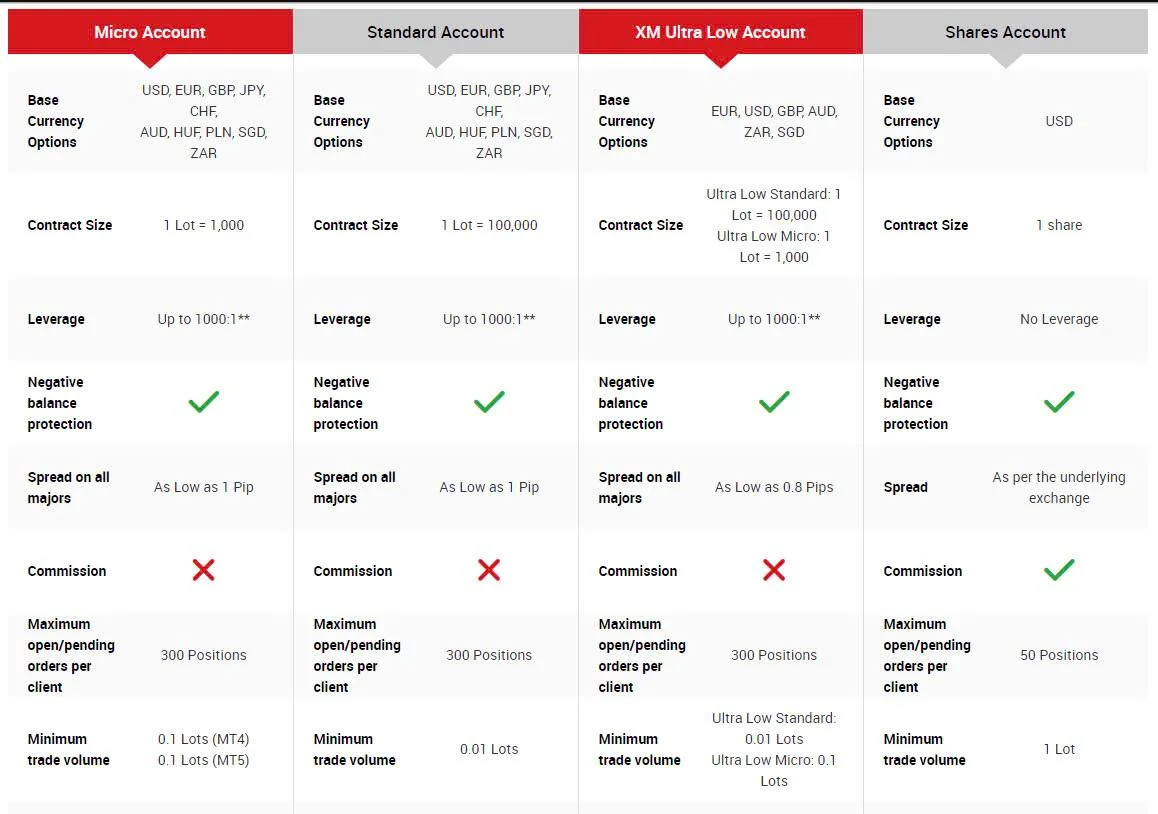

Comparison table of real account types

The table below provides a comparison of the actual account types:

| Account | Type Micro | Standard | Ultra Low | Shares |

| Base Currency | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR | EUR, USD, GBP, AUD, ZAR, SGD | USD |

| Contract Size | 1 lot = 1,000 | 1 lot = 100,000 | Standard Ultra: 1 Lot = 100,000 Micro Ultra: 1 Lot = 1,000 | 1 share |

| Major Pairs Spread | From just 1 pip | From just 1 pip | From just 0.6 pip | Varies by base currency rate |

| Commissions | None | None | None | Applicable |

| Trading Fees | Free | Free | $3.5 per round-turn/per transaction of 1 lot | - |

| Maximum Open/Pending Orders | 300 orders | 300 orders | 300 orders | 50 orders |

| Minimum Order Size | 0.1 lot (MT4) 0.1 lot (MT5) | 0.01 lot | Standard Ultra: 0.01 lot Micro Ultra: 0.1 lot | 1 lot |

| Maximum Lot Size per Order | 100 lots | 50 lots | Standard Ultra: 50 lots Micro Ultra: 100 lots | Varies by stock |

| Order Placement | STP | STP | ECN | - |

| Trading Platform | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT5 |

| Minimum Deposit | $5 | $5 | $5 | $10,000 |

| Trading Rewards | Available | Available | receive trading rewards | No deposit rewards |

==>>Access XM floor here <<==

Depending on each investor's investment goals, they can choose the most suitable account type. For example, if an investor wants to invest small amounts of money and wants to minimize risks, the Micro account or XM Micro Ultra Low account may be the best choice. Meanwhile, if an investor wants to specialize in stock investments, the XM Share account may be a more suitable option.

In summary, comparing the different account types on the XM platform is a useful tool for investors to choose the account type that best suits their needs and investment objectives. However, before deciding to open an account on the XM platform, investors should research the account types thoroughly and carefully consider before making a final decision.

Details of XM account types and characteristics of each type

XM is one of the leading forex and CFD trading platforms in the world. XM was established in 2009 and is owned by Trading Point Holdings Ltd. XM's headquarters is located at Suite 404, The Matalon, Coney Drive, Belize City, Belize and is regulated by CySEC, FCA, ASIC, DFSA, FSC.

A distinguishing feature of the XM platform is that it provides various account types to suit the needs and investment objectives of individual investors, such as: Micro accounts, Standard accounts, XM Ultra Low accounts, Share accounts and Demo accounts. Each account type has its own characteristics suitable for different types of investors. In addition, the XM platform also provides trading products such as forex, stock CFDs, commodity CFDs, index CFDs and cryptocurrency CFDs.

XM provides 5 main account types to users: Micro, Standard, Ultra Low, Share and Demo accounts. Each account type has its own features suitable for the needs and trading purposes of individual investors.

| XM Account Types |

Micro Account

The Micro account is suitable for new and small capital investors. This account requires a minimum deposit of $5 and allows trading with a minimum lot size of 0.1 lots. A special feature of this account is the low spread, from just 1 pip, helping to minimize trading costs.

- Base currencies: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size: 1 lot = 1,000

- Leverage: Up to 1:1000

- Negative balance protection: Yes

- Spread on major pairs: From just 1 Pip

- Commissions: No fees charged

- Maximum open/pending orders per customer: 300 orders

- Minimum order size: 0.1 lot

- Maximum lot size per order: 100 lots

- Hedging: Allowed

- Swap fees overnight: Applicable

- Minimum deposit: $5

Standard Account

The Standard account is the most popular account type on the XM platform. This account requires a minimum deposit of $5 and allows trading with a minimum lot size of 0.01 lots. A special feature of this account is the fixed spread, making it easy for users to calculate trading costs.

- Base currencies: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size: 1 lot = 100,000

- Leverage: 1:1000

- Negative balance protection: Yes

- Spread on major pairs: From just 1 Pip

- Commissions: No fees charged

- Maximum open/pending orders per customer: 300 orders

- Minimum order size: 0.01 lot

- Maximum lot size per order: 50 lots

- Hedging: Allowed

- Swap fees overnight: Applicable

- Minimum deposit: $5

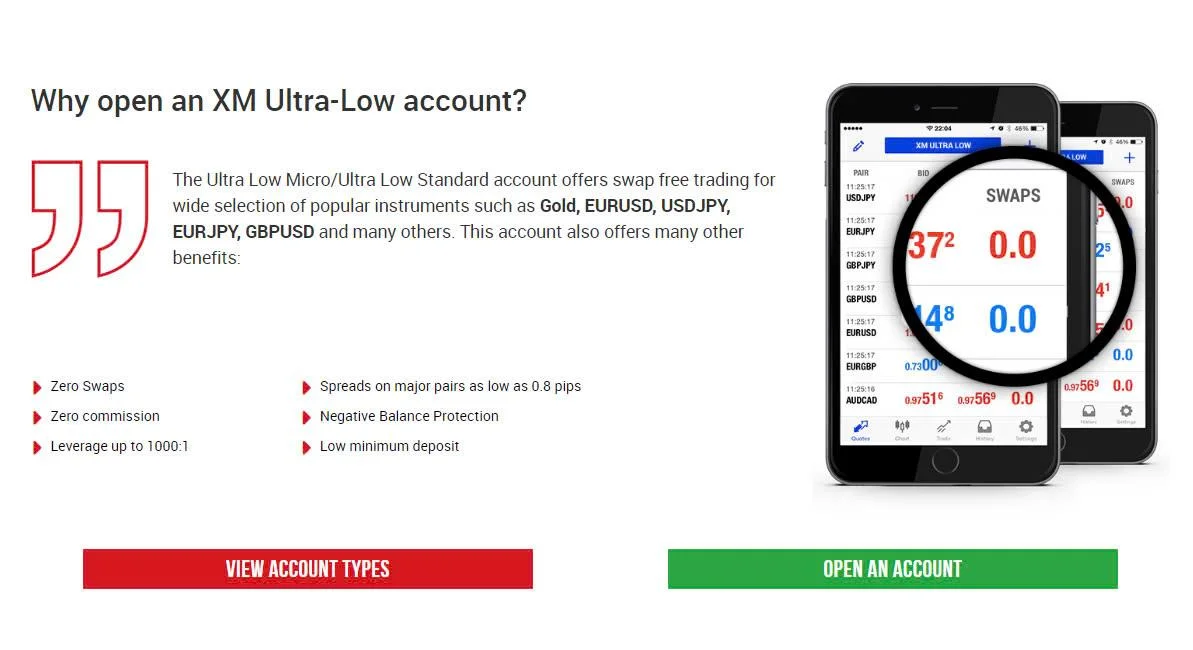

XM Ultra Low Account

The XM Ultra Low account is highly rated by traders and is competitive against other platforms with extremely low spreads from just 0.6 pips, zero overnight swap fees, zero commissions, high leverage and a minimum deposit of just $5.

- Base currencies: EUR, USD, GBP, AUD, ZAR, SGD

- Contract size: 1 lot = 100,000 for Standard Ultra or 1 lot = 1,000 for Micro Ultra.

- Leverage: 1:1000

- Negative balance protection: Yes

- Spread on major pairs: From just 0.6 Pip

- Commissions: No fees charged

- Maximum open/pending orders per customer: 300 orders

- Minimum order size: 0.01 lot for Standard Ultra or 0.1 lot for Micro Ultra

- Maximum lot size per order: 50 lots for Standard Ultra or 100 lots for Micro Ultra

- Hedging: Allowed

- Swap fees overnight: None

- Minimum deposit: $5

XM account types - Share Account

The Share account is for traders specializing in stock trading. However, it has limitations such as no leverage, spread varies by underlying rate, commissions apply, and a high minimum deposit is required.

- Base currency: USD

- Contract size: 1 share

- Leverage: No leverage

- Negative balance protection: Yes

- Spread: Varies by underlying rate

- Commissions: Fees apply

- Maximum open/pending orders per customer: 50 orders

- Minimum order size: 1 lot

- Maximum lot size per order: Varies by stock

- Hedging: Not allowed

- Swap fees overnight: None

- Minimum deposit: $10,000

Demo Account

This is an account that supports new users to familiarize with the trading system before starting with real money. An individual can open up to 5 XM Demo Accounts. Upon account opening, you get an instant $100,000 virtual balance to start practicing trades on the platform - of course this amount cannot be withdrawn.

Which XM account should you invest in - What is the most optimal account?

When deciding to invest on the XM platform, choosing a suitable account is crucial to ensure maximum profits and minimize risks. Currently, XM offers different types of XM accounts. Below are some reviews of each account type to help you choose the most suitable one:

XM Account Types - Micro Account

For investors wanting to trade with small amounts of money.

Suitable for beginners just starting out in forex trading.

Standard Account

For investors wanting to earn larger profits.

Suitable for those with experience in forex trading.

Those who are unsure which account type to open can start with this to earn rewards and choose a more suitable type later.

XM Ultra Low Account

For investors wanting to focus on scalping trades

Suitable for those with experience in forex trading.

Note: This account provides tight spreads so it will not be eligible for rewards and the currency pairs available for trading may be limited.

Share Account

For investors specializing in stock trading.

Demo Account

For new investors wanting to enter the financial markets.

Experienced professionals need a tool to test new trading methods, products and tools to improve investment efficiency.

Therefore, to choose the most suitable account, you need to determine your investment goals, financial situation and trading experience. If you are a beginner or have a small investment capital, the Micro or Demo account is the best choice. If you have experience and average investment capital, the Standard account is the best choice. If you are a stock trading professional, the Share account is the most optimal choice.

In summary, XM offers various account types to suit different needs and trading experience levels. Choosing a suitable account will help traders optimize profits and minimize risks during trading.

Frequently Asked Questions

1. How many accounts can I open on the XM platform?

On the XM platform, you can own up to 10 trading accounts and 1 Shares account.

2. How can I fund my XM account?

XM provides many funding methods such as credit/debit cards, bank wire transfers, e-wallets and digital currency cards. You can choose the funding method that suits you.

3. How can I withdraw money from my XM account?

You can withdraw funds from your XM account via bank wire transfer or transfer back to your e-wallet or digital currency card. However, to withdraw, you need to ensure your account is verified.

4. Can I use trading robots on the XM platform?

XM allows the use of trading robots, but you need to ensure your robot complies with XM's terms and conditions.

5. Can I trade on the XM platform via mobile phone?

XM provides mobile trading apps for both iOS and Android operating systems. You can download the app from your phone's app store and start trading on XM.

6. Can I cancel my XM account?

You can request to cancel your XM account by contacting XM's customer support team. However, before cancellation, you need to ensure all trades and withdrawals have been complete

See more:

What is XM Floor? Is it reputable? XM broker review

Choosing an account type that suits your needs and investment objectives is very important. This article has provided readers with the necessary information about XM account types to help make an informed decision. Consider your options carefully before choosing an XM account and sign up if it suits you.

.png.webp)

.png.webp)