.png.webp)

Envelope MT4: Perfect Tool for Trend and Reversal Detection

Envelope MT4 is an indicator designed to help traders identify price areas that may remain within a certain range compared to the moving average (MA) on MT4. If you want to learn more about this indicator, let me guide you on how to install, display and use the Envelope in the following article!

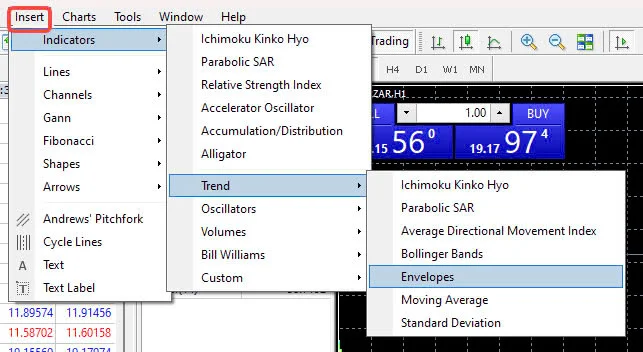

How to display and install Envelope MT4 on PC

Way to display Envelope on MT4/MT5 chart on PC

There are 3 simple ways to display the Envelope on the chart:

Method 1: From the left toolbar of the MT4 (or MT5) screen, select "Add" -> "Supporting Tools" -> "Trend" -> "Envelope".

Method 2: You can also quickly find the "+" icon on the toolbar and select "Trend" -> "Envelope".

Method 3: From the "scrolling window" frame on the left side of the MT4 (or MT5) screen, select Envelope.

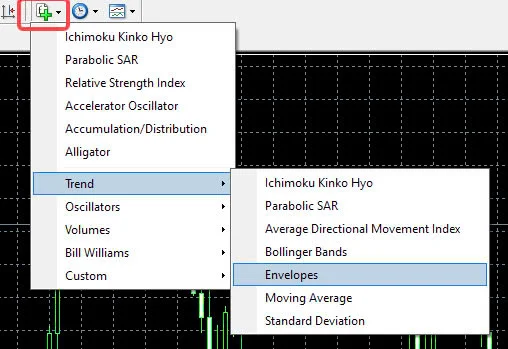

How to configure Envelope

When the Envelope configuration window appears, you can adjust three main parameters: "Period" (Cycle), "MA Method" (MA Method), and "Deviation" (Deviation).

- Period: Options such as 5, 7, 10, 14, 25, 75, 100, etc.

- MA Method: Choose between Simple or Exponential.

- Deviation: Adjust to set the price contact with Envelope.

You can change the Envelope color from the "Colors" setting tab.

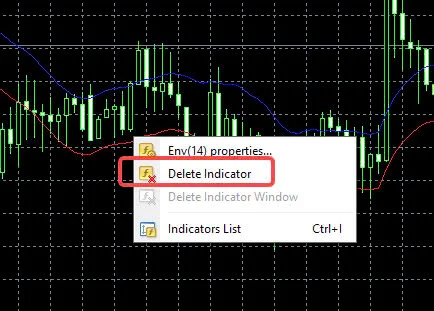

How to remove Envelope MT4 on PC

To remove the Envelope, you can simply click on the chart -> "Supporting Tools" -> "Envelope" -> "Delete".

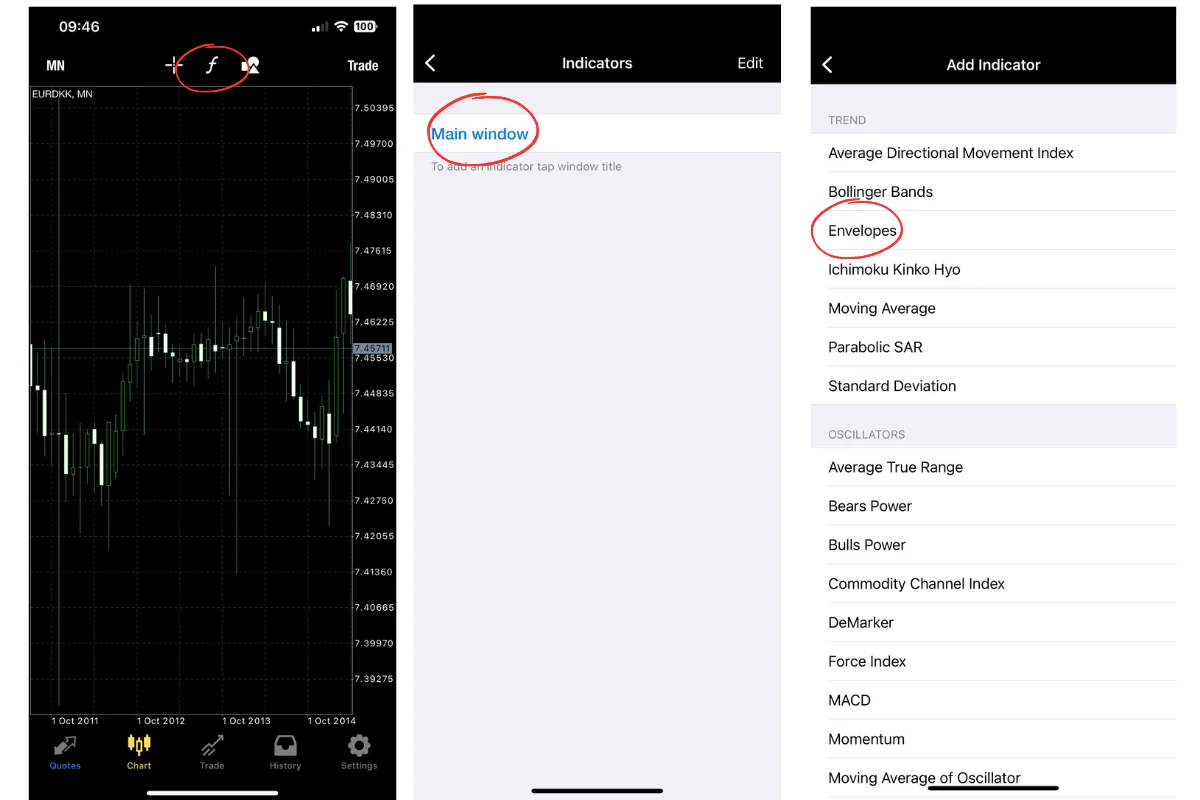

How to display and configure Envelope on Mobile

Open the chart screen from the "Chart tab" of the MT4/MT5 app, touch the "f" icon on the chart screen -> touch the "Main window" from the indicator screen -> Envelope.

At this point, the setting screen will be displayed. Here you can freely change the three positions of "cycle", "deviation", "MA method", and after finishing the change, choose "done".

With just a touch, you have completed displaying the Envelope on your MT4/MT5 chart on your smartphone.

.png.webp)

How to remove Envelope on smartphone

To remove the MT4 Envelope on your phone, go to the "f" icon -> Select "Envelope" by swiping left -> "Delete" appears. After tapping "Delete", you will completely remove the Envelope indicator.

.png.webp)

Ways to configure Envelope

Envelope Cycle

The Envelope cycle is basically the cycle of the moving average it is based on. In other words, the centerline of the Envelope is the moving average.

It is best to choose an Envelope cycle that matches the moving average cycle you normally use. Below are some common cycles for each time frame:

- 15 minutes: 4, 8, 12, 16, 20, 24, 48, 64, 96...

- 1 hour: 4, 8, 12, 24, 36, 48, 72, 96, 120...

- 4 hours: 2, 4, 6, 12, 24, 60, 120, 240...

- Daily: 5, 10, 20, 25, 50 days, 75, 100, 200...

- Weekly: 13, 26, 52 weeks...

- Monthly: 12, 24, 60 months...

Envelope Method

Envelope is a technical indicator that shows the distance within a certain central moving average line, so you need to establish the type of moving average line that you will use for the central moving average.

In stock trading and Forex, two types of moving averages are commonly used: "Simple Moving Average (SMA)" and "Exponential Moving Average (EMA)". However, in the highly volatile forex market, the Exponential Moving Average (EMA) is often more effective because it prioritizes more recent prices over the Simple Moving Average (SMA).

Types of moving averages and symbols on MT4:

- Simple Moving Average (SMA): Symbol "Simple"

- Exponential Moving Average (EMA): Symbol "Exponential"

- Smoothed Moving Average (SMMA): Symbol "Smoothed"

- Weighted Moving Average (WMA): Symbol "LinearWeighted"

Envelope Deviation

The deviation of the Envelope MT4 is the distance from the designated moving average line to the upper and lower Envelope lines, according to the deviation setting you have chosen.

The deviation value can vary significantly depending on the volatility of the cycle, price, or timeframe of the chart, so you need to adjust the deviation value to suit the current market situation.

A tip when setting is to adjust the value so that the Envelope line touches important points on the chart.

Here are some reference values for Envelope deviation when the cycle is 14:

- 5 minutes: 0.01 to 0.05

- 15 minutes: 0.05 to 0.15

- 1 hour: 0.15 to 0.40

- 4 hours: 0.60 to 0.80

- Day: 1.00 to 1.50

- Week: 3.00 to 3.50

Guide to Configuring Envelope Deviation Accurately

The deviation of the Envelope needs to be adjusted based on the volatility of the market price, as previously mentioned. Therefore, a fixed setting cannot be continuously applied; you need to adjust the deviation appropriately based on current market conditions before trading.

Adjust Deviation at Price Points Touching Upper/Lower Envelope Limits

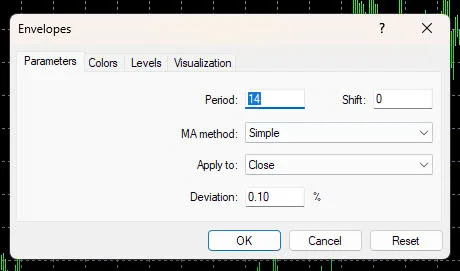

The chart below shows the Envelope set for the USD/JPY currency pair, 1-hour timeframe, 14-period, Exponential method and 2% deviation.

Looking at the chart, you can see that the upper and lower envelope limits are too far from the high and low prices of the market, making it difficult to judge transactions.

At points where the price touches the upper/lower limits of the Envelope, there is subsequent price fluctuation upwards or downwards. If the deviation is set close to the touch point, you will find it easier to make trading decisions.

-1.png.webp)

Examples of Incorrect Envelope Configuration

The next chart shows the USD/JPY Envelope, 1-hour timeframe, 14-period, Exponential method and 0.4% deviation.

-2.png.webp)

Based on the chart, you can see that when the price touches the upper and lower limits of the Envelope, there is subsequent upward or downward volatility. If the deviation is set near the touch point, you will find it easier to make trading decisions.

Effective Trading Methods with Envelope

There are two main trading methods when trading using Envelope:

Counter-trend Trading at Upper and Lower Limits

In a market without a clear trend, you can trade counter-trend when the price touches the upper or lower limits of the Envelope.

Example of Envelope Trading:

.png.webp)

In the chart above, you can take trades such as: sell when the price touches the upper limit of the Envelope (green circle), buy when it touches the lower limit (red circle) and place a break-even stop when the price moves against your trade direction (green triangle).

Method:

In a trendless market, you can profit by selling at the upper limit and buying at the lower limit of the Envelope MT4. Take the loss if the price moves against your position.

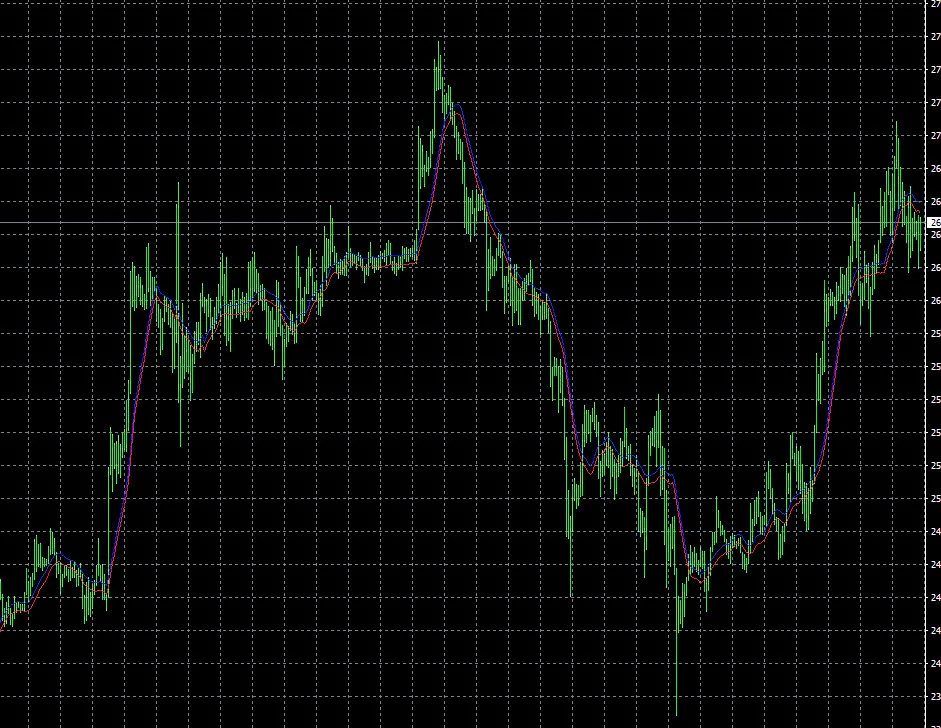

Trend Trading from Center Value to Upper/Lower Limits

In a trending market, you can trade the trend from the Envelope's center value to the upper or lower limits.

.png.webp)

Method:

In a trending market, you can profit by trading the trend from the center value of the Envelope and closing orders at the upper or lower limits. Take a loss if the price touches the upper or lower limits going against your order direction.

See also:

- Boost Your Trading Strategy with MACD MT4 Indicator Setup Guide

- RSI MT4 Guide: Maximize Profits with Precision Trade Signals

The Envelope indicator, with its flexible adjustment capability, is a useful tool in a technical analyst's toolkit. However, like any analysis tool, it should be used in combination with other methods and tools to make more accurate trading decisions.

I hope the information provided by Smartlytrading has helped you understand and grasp how to use the Envelope MT4 indicator! All the best with your trading.

.png.webp)

.png.webp)