.png.webp)

Moving Average MT4 - A Key Tool for Smarter Trading

In the previous article, I introduced an overview of MACD on MT4. In this article, I will guide you on how to display the moving average MT4 and how to use it accurately. Let's follow along!

Guide to displaying the moving average line on MT4

The moving average (Moving Average) is a popular technical indicator for market analysis, which smoothens price data to easily identify trends. Below are detailed instructions on how to display the moving average line on the MT4 and MT5 trading platforms, both on PC and smartphone.

1. How to display the moving average MT4/MT5 for PC

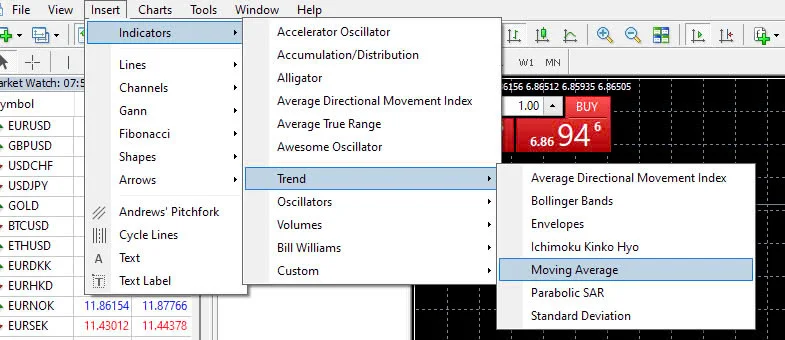

To display the moving average line on MT4/MT5, follow these steps:

Open MT4 or MT5 and choose the chart you want to apply the indicator to.

On the toolbar, choose "Add" -> "Support Tools" -> "Trend" -> "Moving Average"

At this point, a window will pop up:

Indicator settings:

To configure the indicator, change the following parameters:

- Period: Choose an appropriate time period (e.g. 5, 7, 10, 14, 25, 75, 100).

- MA Type: Choose between Simple (Simple Moving Average) or Exponential (Exponential Moving Average).

- Style: Choose the color and line style as desired.

=> Click "OK" to apply.

You can also display multiple moving averages to analyze short-term, medium-term and long-term trends by repeating the above steps with different settings.

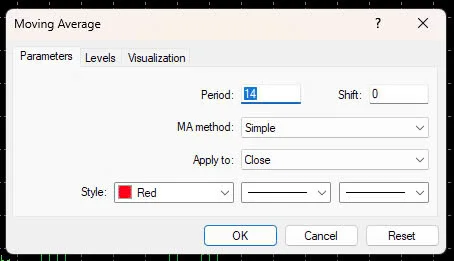

2. How to display the MT4/MT5 moving average on a smartphone

Open the MT4/MT5 app on your smartphone and tap the "f" icon on the chart screen to open the indicators menu.

Next, select "Main Window" from the indicators screen.

Find and tap "Moving Average" in the list of indicators.

After selecting "Moving Average", the settings screen will appear.

Change the parameters:

- Period: Choose an appropriate time period.

- Type (moving average type): Choose the average type.

- Style: Choose the color and line style as desired.

- Tap "Done" to apply.

With these steps, you can easily add and configure the MT4 moving average on your charts to effectively analyze price trends.

The role of moving average MT4 in forex

The moving average (MA) is a popular technical analysis tool in financial trading, used to smooth price fluctuations and identify trends. There are three main reasons why moving averages are widely used in market analysis:

- Evaluate the strength and direction of the market: MAs help identify and assess the strength of the current market trend.

- Identify market volatility points: Using MAs helps identify points where the market may experience large fluctuations, helping predict price changes.

- Identify resistance and support levels: MAs support predicting resistance and support levels, determining where prices may see significant changes.

A chart without moving averages can give you an overall view of the trend but cannot provide detailed information about price volatility.

When the MT4 moving average is added to the chart, it helps you better understand the strength of trends, volatility points, and trend changes.

.png.webp)

In the chart above from September 27, 2023 to August 2, 2024:

- Looking at the MA25 line, which is the moving average of the last 25 periods, this period would have both upward and downward trends (downward from October 15 to December 26, 2023).

- Looking at the MA200 line, the entire period was in an upward trend.

Moving averages have long been used in statistical analysis and in 1962, JE Granville popularized applying them to market analysis. This is a basic and very popular technical analysis tool that many investors rely on.

4. Common Types of Moving Averages in the Market

There are many types of moving averages with different calculation methods, each with their own characteristics affecting how they react to price fluctuations. Below are the calculation methods and features of the four main types of moving averages:

Simple Moving Average (SMA)

The SMA calculation method takes the average of the closing prices over a specific number of periods.

Formula:

SMA = SUM (CLOSE (i), N) / N

Where:

- SUM = Total

- CLOSE (i) = Current period's closing price

- N = Value of the period used in the calculation

SMA or MA helps clearly and easily identify long-term trends. By smoothing price data, it provides an overview of the market's main trend, helping investors better understand the long-term direction of prices.

However, MA or SMA may react slowly to recent price fluctuations. This means it can lag in identifying rapid changes in the market, especially in highly volatile and fast-moving markets.

Exponential Moving Average (EMA)

The EMA is calculated by applying a special formula to smooth closing prices over a given time period, using a specific smoothing factor.

The purpose of EMA is to overcome the lag problem that simple moving averages (SMA) often experience in reflecting price volatility.

EMA calculation formula:

EMA = (CLOSE (i) * P) + (EMA (i -1) * (1 – P))

Where:

- CLOSE (i) = Current period's closing price

- EMA (i -1) = Previous period's moving average

- P = Percentage used for the price value

EMA has a faster reaction to recent price changes compared to the Simple Moving Average (SMA). This helps traders update more quickly and accurately to current market conditions.

However, when markets experience large exchange rate fluctuations or unclear trends, EMA can produce many false signals. This can make it difficult for traders to accurately identify trading opportunities.

Smoothed Moving Average (SMMA)

The Smoothed Moving Average MT4 (SMMA) is an improved version of EMA, providing higher smoothness than SMA or EMA. It provides a clearer view of long-term trends compared to the simple moving average.

Smoothed Moving Average (SMMA) calculation formula:

SMMA = (SMMA (i -1) * (N -1) + CLOSE (i)) / N

- SMMA (i-1) = Previous period's smoothed moving average

- N = Smoothing period

- CLOSE (i) = Closing price

SMMA provides a clearer view of long-term trends than the Simple Moving Average (SMA), making it easier for traders to identify overall market trends.

However, SMMA has a slower reaction to recent price changes, which can reduce the ability to capture trading signals in a timely manner during short-term market fluctuations.

Weighted Moving Average (WMA)

The Weighted Moving Average (WMA) is a type of moving average that focuses more on the most recent prices compared to the Exponential Moving Average (EMA).

WMA is calculated by assigning weights to each closing price within the period, with the most recent price receiving the highest weight, more accurately reflecting recent price volatility.

Weighted Moving Average (WMA) calculation formula:

LWMA = SUM (CLOSE (i) * i, N) / SUM (i, N)

Where:

- SUM = Total

- CLOSE(i) = Closing price

- SUM (i, N) = Total weighting factor

- N = Smoothing period

WMA prioritizes recent prices, so it responds fastest among moving average types, helping traders identify price changes in a timely manner.

However, due to its focus on recent prices, WMA can generate more false signals than other types of moving averages, especially in highly volatile or unstable markets.

In summary, WMA responds the quickest but may be less accurate, while SMMA provides the best view of long-term trends but responds slower to recent changes. Traders should choose based on their strategy and market conditions.

Which MT4 moving average should be used?

Each type of moving average has its own advantages and disadvantages, so you can choose the one that suits your market and preferences. However, the exponential moving average (EMA) is the most popular choice worldwide.

EMA usually responds faster to recent price changes than the simple moving average (SMA). This means that when trading over short periods of time, from a few minutes to an hour, you will miss fewer opportunities. In particular, the green EMA often responds faster to price decreases and also accelerates more easily when prices rise.

Trading methods using moving average MT4

Using moving averages is a popular technical analysis tool for identifying trends and entry points in financial markets.

Below are the four main methods when using moving averages:

1. Trend-following method

This method is based on the trend of the moving averages to identify trading opportunities. If the moving average is rising, this indicates an upward trend, and you should consider taking a buy order. Conversely, if the moving average is falling, this indicates a downward trend, and you should consider taking a sell order.

.png.webp)

When the short-term, medium-term and long-term moving averages align in the same direction (called a "perfect order"), the reliability of buy or sell signals based on that trend increases.

2. Trading method based on support and resistance lines

In this method, the MT4 moving average is considered a type of resistance (Resistance line) or support line (Support line). When the price touches or breaks through the moving average, trading decisions can be made based on the following signals:

Buy signal:

- Price rises above the moving average.

- Price volatility increases above the moving average.

Sell signal:

- Price falls below the moving average.

- Price volatility decreases below the moving average.

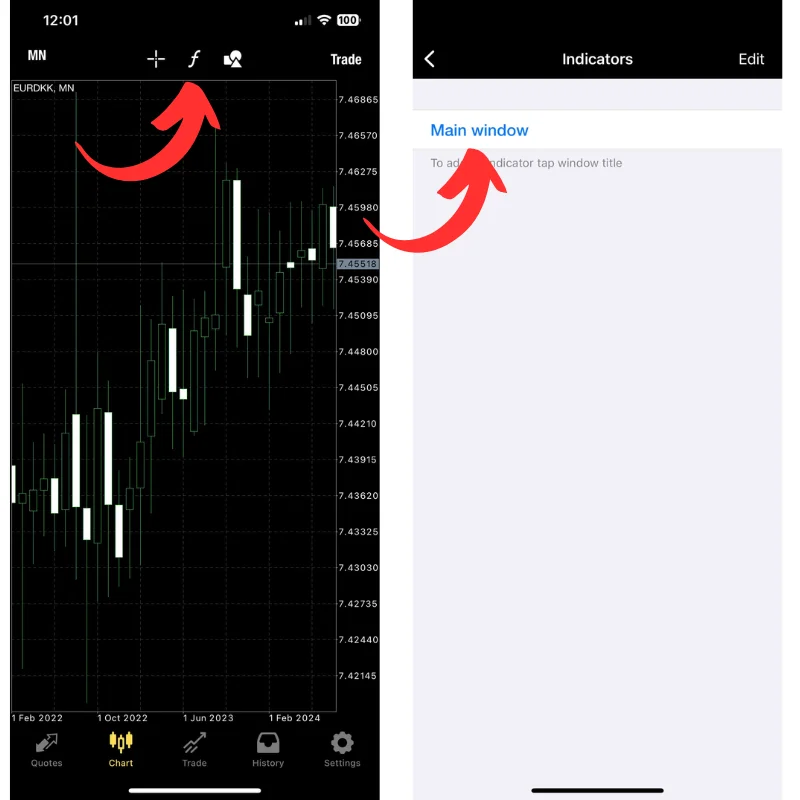

3. Trading method using crossover between multiple moving averages

This method is based on the intersection points between short-term, medium-term and long-term moving average MT4 to determine entry points. There are two main signals:

- Golden Cross: When the short-term moving average rises above the medium-term and long-term moving averages, it is a buy signal.

- Death Cross: When the short-term moving average falls below the medium-term and long-term moving averages, it is a sell signal.

.png.webp)

4. Trading method based on Granville's rules

Granville's law, developed by Joseph E. Granville, divides buy and sell signals into four main criteria for each:

Basis for buying judgment:

- The MT4 moving average is rising and the price penetrates from the bottom to the top.

- Even if the price falls below the moving average, the moving average is still rising back.

- The price does not fall below the moving average but rises back again.

- The price deviates far from the moving average and decreases greatly (high deviation ratio).

Basis for selling judgment:

- The moving average is falling and the price penetrates from the top to the bottom.

- Even if the price rises above the moving average, the moving average is still falling back.

- The price does not rise above the moving average but falls back again.

- The price deviates far from the moving average and increases greatly (high deviation ratio).

Each of these methods provides different approaches to using moving averages to optimize your trading decisions in the market.

Weaknesses of moving averages investors should know

The main weakness of moving averages is that they can be easily "fooled", leading to inaccurate signals in some situations.

When the price breaks through the moving average, this can be understood as a change in trend. However, sometimes this is only a temporary fluctuation and the price may return to its original direction later.

For example, if the moving average normally acts as a resistance level, it can provide wrong buy or sell signals when the price breaks through it, only to decrease back later. This is called "fooled" and can lead to wrong trading decisions, causing losses for investors.

Financial experts, especially institutional investors, believe this fooling phenomenon occurs for some reasons, including large transactions that can temporarily change the price trend to profit from the deviations of retail investors.

Limiting the weaknesses of the moving average line.

To minimize issues related to weaknesses of the moving average MT4 line, some following methods can be applied:

- Display moving averages with different time periods

- Additional display of momentum indicators such as MACD

- Additional display of trend indicators such as envelopes, etc.

- Combining multiple moving averages

Example combining multiple moving averages

This chart illustrates displaying three MT4 moving averages (MA12, MA36 and MA50) at the same time.

Although the decoy point highlighted in red when following MA12, but since the other moving averages show that the price is trending up, you can predict that the price will touch the MA36 and MA50 lines and may continue to rise.

Using multiple moving averages can help reduce the impact of decoy points.

In addition, combining other technical indicators such as MACD and envelopes can also help identify decoy points more accurately.

Moving average MT4 can be drawn in various ways depending on the type and time period, so it is a simple but also quite complex technical indicator to use. Depending on your trading style, such as short-term or long-term trading, the cycle will need to be adjusted differently. Therefore, for new traders, you should be cautious to test trades on a demo account to check which cycle is most suitable for you.

You may also be interested in:

- MT4 vs MT5: Key Differences to Boost Your Trading Efficiency

- Remove XM MT4 Safely: Quick and Easy Removal Process

Conclusion

It can be seen that the moving average is a useful tool to help investors better understand market trends, identify important volatility points, and find potential resistance or support levels.

Hopefully with the information provided by Citinews, you now have a better understanding of how to draw moving average MT4! Wishing you the best of success in your endeavors.

.png.webp)

.png.webp)